Guarding Your Possessions: Trust Structure Experience at Your Fingertips

In today's complicated monetary landscape, making certain the security and growth of your assets is critical. Depend on structures offer as a keystone for guarding your wealth and legacy, offering a structured method to possession defense.

Significance of Trust Structures

Count on structures play an essential function in developing reliability and fostering strong relationships in numerous expert settings. Structure trust fund is crucial for services to flourish, as it creates the basis of successful collaborations and collaborations. When trust is present, people really feel a lot more positive in their interactions, leading to raised performance and effectiveness. Count on foundations act as the keystone for honest decision-making and transparent interaction within companies. By prioritizing trust, organizations can produce a positive job culture where employees really feel valued and appreciated.

Benefits of Professional Support

Structure on the structure of trust fund in specialist partnerships, looking for specialist advice supplies invaluable advantages for people and companies alike. Specialist support supplies a riches of understanding and experience that can help navigate intricate economic, lawful, or calculated difficulties with simplicity. By leveraging the experience of specialists in different areas, individuals and organizations can make enlightened choices that line up with their goals and aspirations.

One substantial advantage of expert guidance is the capacity to accessibility specialized understanding that may not be conveniently offered otherwise. Experts can supply understandings and point of views that can result in innovative remedies and chances for growth. In addition, dealing with experts can aid alleviate risks and unpredictabilities by giving a clear roadmap for success.

In addition, professional assistance can conserve time and resources by streamlining procedures and preventing pricey errors. trust foundations. Professionals can provide customized advice tailored to details requirements, ensuring that every decision is educated and calculated. Overall, the advantages of expert support are complex, making it an important property in protecting and taking full advantage of assets for the lengthy term

Ensuring Financial Security

In the realm of financial preparation, safeguarding a steady and flourishing future rest on calculated decision-making and sensible investment choices. Making sure economic security includes a complex approach that encompasses various elements of wide range management. pop over to these guys One important component is creating a diversified investment portfolio tailored to private danger resistance and financial objectives. By spreading investments across different possession classes, such as supplies, bonds, property, and assets, the threat of substantial economic loss can be minimized.

Furthermore, preserving a reserve is vital to protect against unanticipated expenses or revenue interruptions. Professionals suggest alloting three to six months' worth of living expenses in a fluid, quickly available account. This fund acts as a financial safety internet, offering tranquility of mind during unstable times.

Regularly examining and readjusting monetary strategies in action to altering situations is also critical. Life occasions, market fluctuations, and legal adjustments can affect economic security, emphasizing the value of recurring assessment and adaptation in the quest of long-term economic protection - trust foundations. By applying these techniques attentively and regularly, people can fortify their financial ground and job in the direction of an extra secure future

Protecting Your Possessions Effectively

With a strong structure in area for monetary protection with diversity and reserve maintenance, the following important step is guarding your properties properly. Securing assets involves protecting your riches from potential threats such as market volatility, financial slumps, claims, and unforeseen expenses. One effective method is possession allocation, which entails spreading your financial investments throughout various asset classes to lower risk. Diversifying your portfolio can help mitigate losses in one area by balancing it with gains in another.

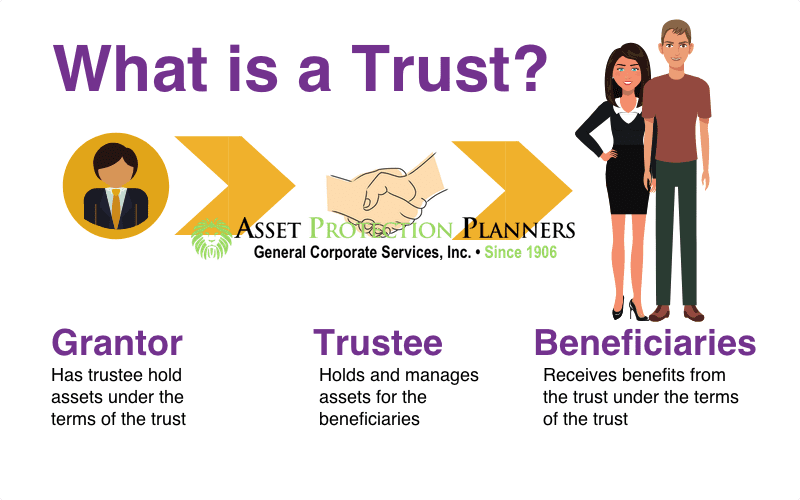

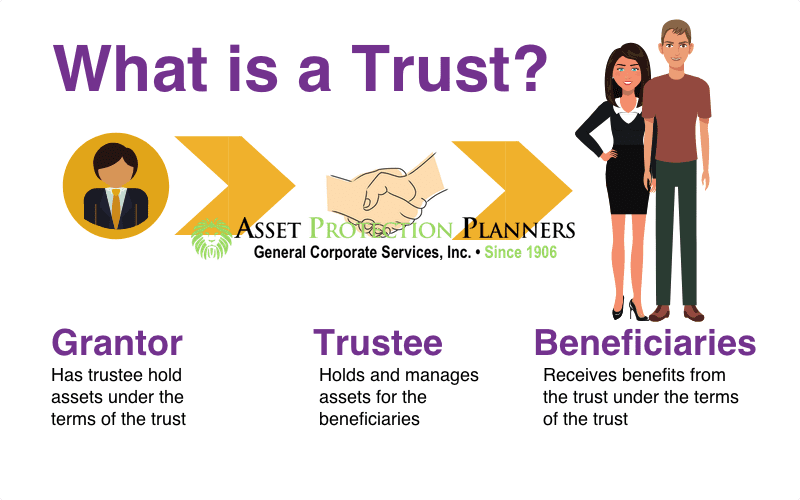

In addition, developing a trust fund can offer a safe way to shield your assets for future generations. Trusts can assist you manage exactly how your dig this possessions are distributed, lessen inheritance tax, and safeguard your wide range from financial institutions. By carrying out these techniques and looking for professional suggestions, you can guard your properties properly and secure your monetary future.

Long-Term Asset Protection

Long-term asset security entails carrying out steps to protect your possessions from different hazards top article such as economic slumps, lawsuits, or unforeseen life occasions. One important aspect of lasting asset protection is developing a trust fund, which can offer significant advantages in securing your assets from financial institutions and lawful disputes.

Moreover, expanding your financial investment portfolio is one more crucial strategy for long-term asset protection. By taking an aggressive technique to long-term possession security, you can protect your wide range and give financial safety for yourself and future generations.

Conclusion

To conclude, trust structures play a crucial role in protecting properties and making certain economic protection. Expert advice in establishing and handling trust frameworks is crucial for long-term asset security. By utilizing the competence of experts in this area, individuals can properly protect their assets and strategy for the future with confidence. Depend on foundations supply a strong structure for shielding wide range and passing it on to future generations.